Guide to Outstanding Checks

However, it is ultimately up to the receiving bank whether they will cash (or deposit) a check or not. As a result, the actual displayed amount in an account (meaning current or available balance) can vary from time to time. Of course, it’s best practice to deposit a check as soon as you receive it, which is why most checks include language encouraging a timely deposit. However, by the end of the month, the landlord still needs to deposit the check. When Sarah receives her bank statement, it shows a balance of $5,000, but her accounting records indicate a balance of $4,200, taking into account the outstanding rent check. Checks that remain outstanding for long periods of time cannot be cashed as they become void.

If the Check Is Less Than Six Months Old

That said, both outstanding checks and outstanding deposits refer to transactions that have not yet been posted to your account. Proper management of outstanding checks involves tracking, reconciliation, timely communication, and ensuring sufficient funds are available to honor the checks when presented for payment. Outstanding checks are checks that have been issued but not yet presented for payment or cleared by the bank. They represent pending transactions where the funds have not yet been deducted from the issuer’s account.

Outstanding Business Checks

Regardless of the nature of the error, it is important to address it promptly to avoid any potential consequences. Putting a stop payment on a misplaced or stale check may prevent issues down the road, especially if there’s a concern that it could fall into the wrong hands. However, this doesn’t always solve the problem, as it costs a fee to the payor and is only valid for a limited time. ◦ Working with the bank to ensure a stale check gets deposited might require time and effort.

The Risk of Stale Checks and the Need for Stop Payments

The check bounces because it cannot be processed, as there are insufficient or non-sufficient funds (NSF) in the account (the two terms are interchangeable). A check is a bill of exchange or document that guarantees https://www.bookstime.com/ a certain amount of money. It is printed for the drawing bank to provide to an account holder (the payor) to use. The payor writes the check and gives it to the payee, who then takes it to their bank for cash or to deposit into an account.

A certified check is a personal check that the account holder’s bank has verified contains sufficient funds and bears a legitimate signature. A certified check can come in handy when buying something from a seller who wants proof the check won’t bounce. Now, the adjusted bank balance matches the company’s book balance, indicating that the difference was due to the outstanding check. Ask the payee to sign a document promising not to deposit both checks.

Outstanding Check

- Outstanding checks refer to checks that have been issued to a recipient but have not yet been cashed by the recipient or the recipient’s bank.

- This also helps to understand the intended use of the check in case the payee loses or faces check theft.

- ◦ You might have to visit a branch location to make the request, and there could be a fee involved.

- The payor, or person with the checking account, writes a check to the person they want to pay in the payment amount.

- In the U.S., outstanding checks are considered to be unclaimed property and the amounts must be turned over to the company’s respective state after several years.

If so, you can get access to GlobalBanks USA (our dedicated US banking service) in just a few clicks. The offers that appear on this site are from companies that compensate check is outstanding means us. But this compensation does not influence the information we publish, or the reviews that you see on this site.

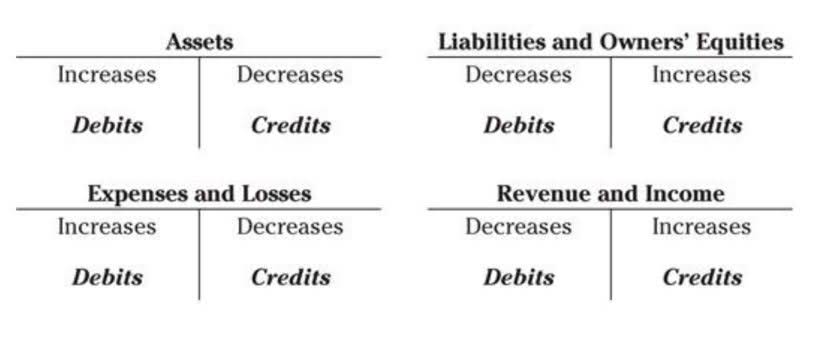

Is an outstanding check a debit or credit?

- A check you’ve written clears when the funds successfully move from your account to the bank account of the person depositing the check.

- While a savings account may be where you store money for emergencies or financial goals, money moves in and out of your checking account frequently.

- On August 30, Butterfly Industries wrote a check for $500 to a supplier for office supplies.

- When a check is written, it serves as a promise of payment from the issuer to the recipient.

- In a bank reconciliation the outstanding checks are a deduction from the bank balance (or balance per the bank statement).

- When the check is cashed or deposited, it is no longer considered outstanding, and the payor can reconcile the payment with the pending transaction.

- This can happen due to various reasons such as delays in the mail, delays in depositing the check, or the recipient simply not cashing the check yet.

Additionally, outstanding checks can affect your budgeting and financial planning. You may think you have a certain amount of money available, but if there are outstanding checks that haven’t been accounted for, you could end up overspending. Have you ever experienced the frustration of receiving an outstanding check due to insufficient funds? It can be quite a headache, especially when you were counting on that money. Understanding the reasons behind these checks can help shed some light on this issue.

Guide to checking account terminology

When a check bounces due to insufficient funds, it can be reported to credit bureaus and appear as a negative mark on the person’s credit https://www.facebook.com/BooksTimeInc/ report. This can lower their credit score and make it more difficult to obtain credit in the future. Lenders and financial institutions consider a person’s credit score when evaluating their creditworthiness, and a lower score can result in higher interest rates or even denial of credit.

- An outstanding check example could be a rent check you mailed to your landlord, but they have not deposited it yet.

- However, it is ultimately up to the receiving bank whether they will cash (or deposit) a check or not.

- Also, always maintain in communication with payees about payments not fully processed.

- The check bounces because it cannot be processed, as there are insufficient or non-sufficient funds (NSF) in the account (the two terms are interchangeable).

- If the old check is deposited, your bank might honor it, and you could consequently end up paying double.

How Checks Work

Once such checks are finally deposited, they can cause accounting problems. Furthermore, checks that are never cashed may constitute “unclaimed property” that is turned over to the state. The payor, or person with the checking account, writes a check to the person they want to pay in the payment amount. The payor gives it to the payee and notes the amount of that check as a “pending” payment until the check fully clears and the account balance is adjusted by the bank to account for the payment. A check becomes outstanding simply by not being cashed or deposited.